Business Insurance in and around Columbia

Calling all small business owners of Columbia!

Almost 100 years of helping small businesses

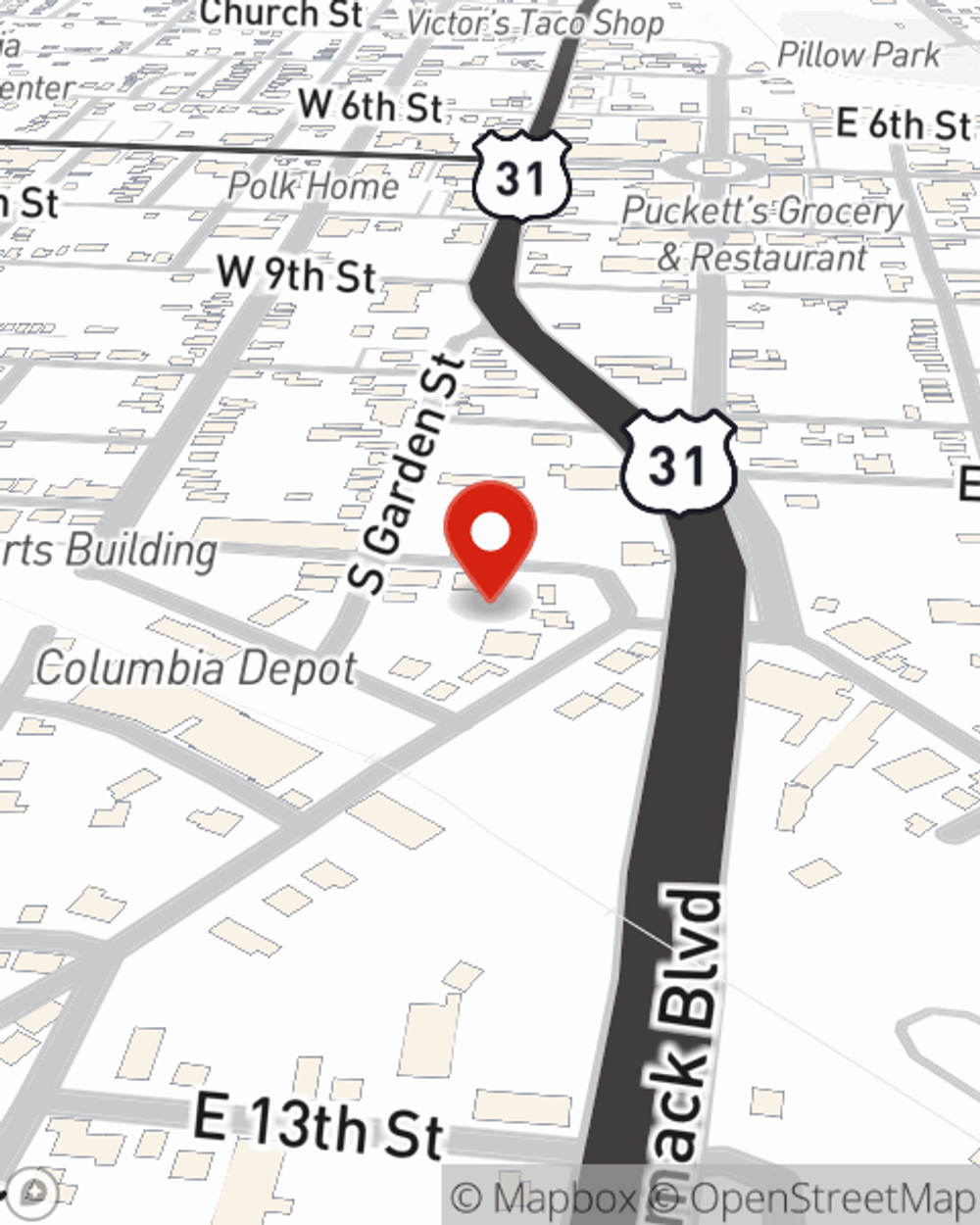

- Columbia

- Mount Pleasant

- Spring Hill

- Franklin

- Dickson

- Lewisburg

- Lawrenceburg

- Shelbyville

- Brentwood

- Nashville

- Fairview

- Kingston Springs

- Lyles

- Williamson County

- Marshall County

- Giles County

- Lawrence County

- Lewis County

- Dickson County

- Maury County

- Hickman County

- Culleoka

This Coverage Is Worth It.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent JennaLynn Drake. JennaLynn Drake understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Calling all small business owners of Columbia!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

Whether you are a florist a photographer, or you own a camera store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent JennaLynn Drake can help you discover coverage that's right for you and your business. Your business policy can cover things such as business property and equipment breakdown.

At State Farm agent JennaLynn Drake's office, it's our business to help insure yours. Reach out to our outstanding team to get started today!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

JennaLynn Drake

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.