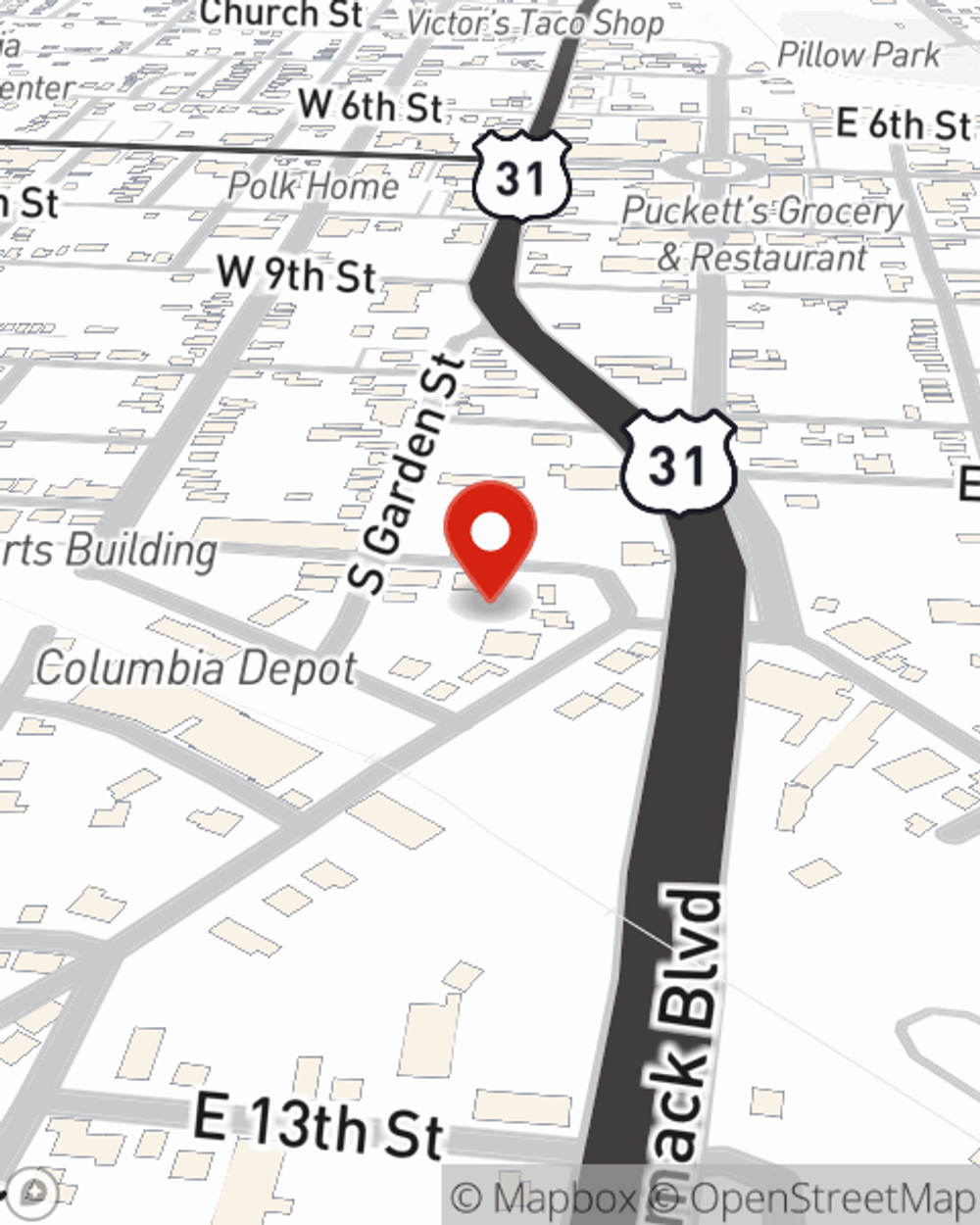

Life Insurance in and around Columbia

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Columbia

- Mount Pleasant

- Spring Hill

- Franklin

- Dickson

- Lewisburg

- Lawrenceburg

- Shelbyville

- Brentwood

- Nashville

- Fairview

- Kingston Springs

- Lyles

- Williamson County

- Marshall County

- Giles County

- Lawrence County

- Lewis County

- Dickson County

- Maury County

- Hickman County

- Culleoka

Check Out Life Insurance Options With State Farm

Taking care of those you love is what keeps you going every day. You go to work to provide for them advise them on important decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Get insured for what matters to you

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

Fortunately, State Farm offers numerous coverage options that can be personalized to align with the needs of those most important to you and their unique situation. Agent JennaLynn Drake has the personal attention and service you're looking for to help you pick a policy which can aid your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to discover what a State Farm policy can do for you? Visit State Farm Agent JennaLynn Drake today.

Have More Questions About Life Insurance?

Call JennaLynn at (931) 548-4010 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

JennaLynn Drake

State Farm® Insurance AgentSimple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.