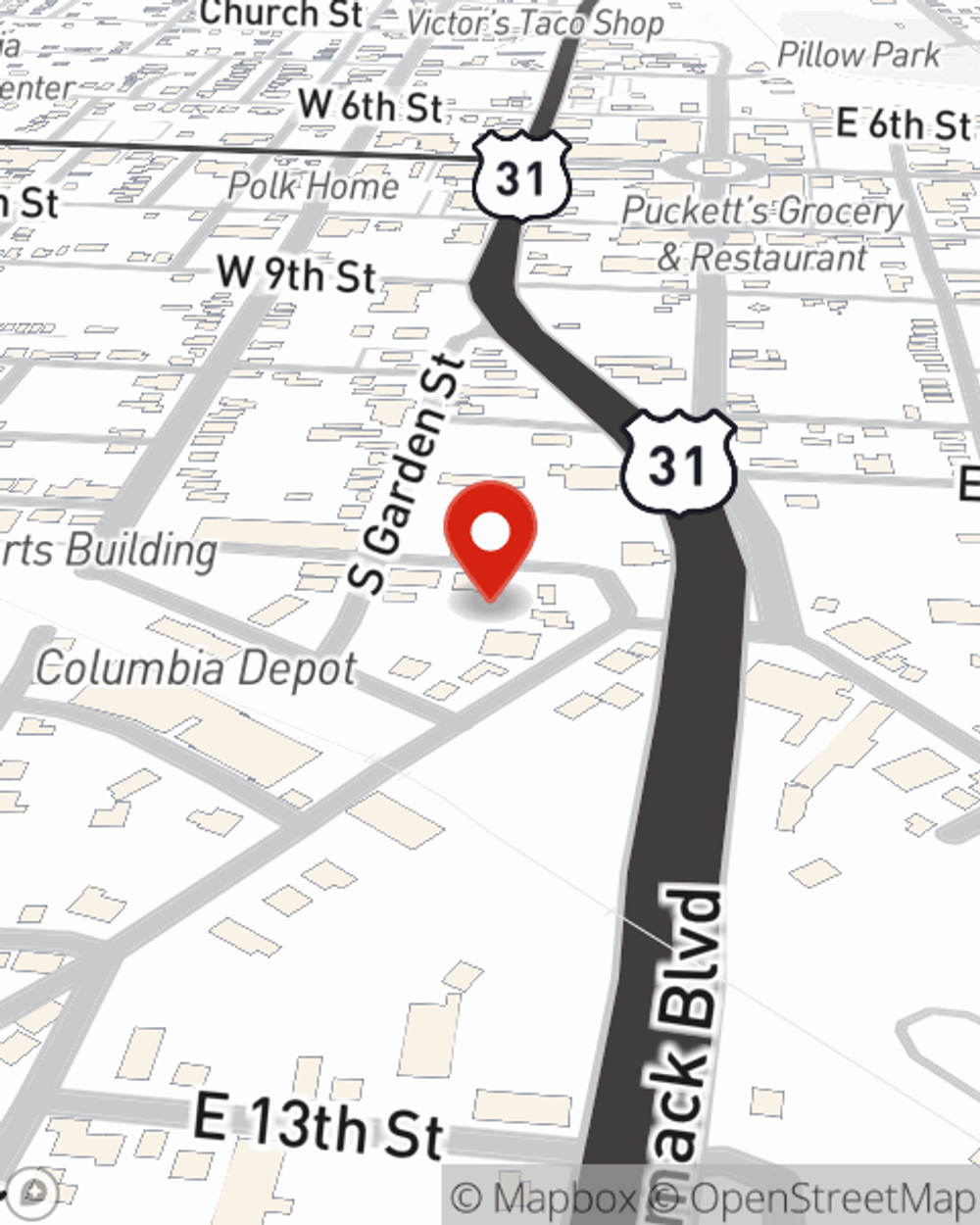

Renters Insurance in and around Columbia

Renters of Columbia, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Columbia

- Mount Pleasant

- Spring Hill

- Franklin

- Dickson

- Lewisburg

- Lawrenceburg

- Shelbyville

- Brentwood

- Nashville

- Fairview

- Kingston Springs

- Lyles

- Williamson County

- Marshall County

- Giles County

- Lawrence County

- Lewis County

- Dickson County

- Maury County

- Hickman County

- Culleoka

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - outdoor living space, price, number of bathrooms, condo or apartment - getting the right insurance can be important in the event of the unanticipated.

Renters of Columbia, State Farm can cover you

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

The unanticipated happens. Unfortunately, the stuff in your rented space, such as a set of favorite books, a TV and a stereo, aren't immune to fire or abrupt water damage. Your good neighbor, agent JennaLynn Drake, has a true desire to help you know your savings options and find the right insurance options to protect your belongings.

Call or email State Farm Agent JennaLynn Drake today to check out how a State Farm policy can protect items in your home here in Columbia, TN.

Have More Questions About Renters Insurance?

Call JennaLynn at (931) 548-4010 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

JennaLynn Drake

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.